december child tax credit amount 2021

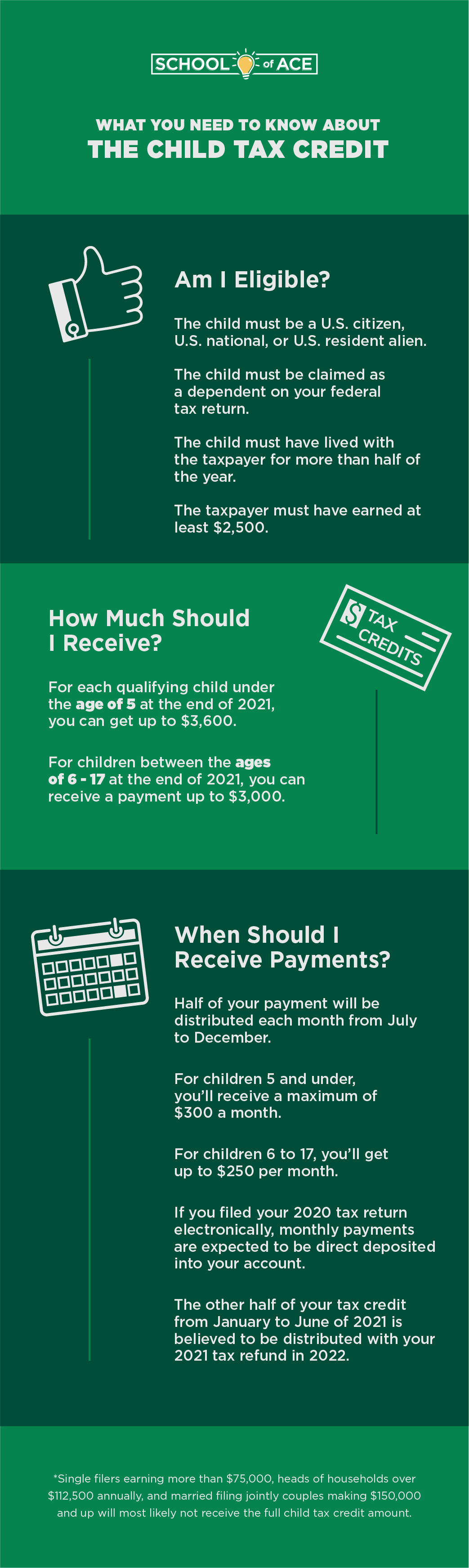

The total credit is as much as 3600 per child. For 2021 eligible parents or guardians.

What To Know About The First Advance Child Tax Credit Payment

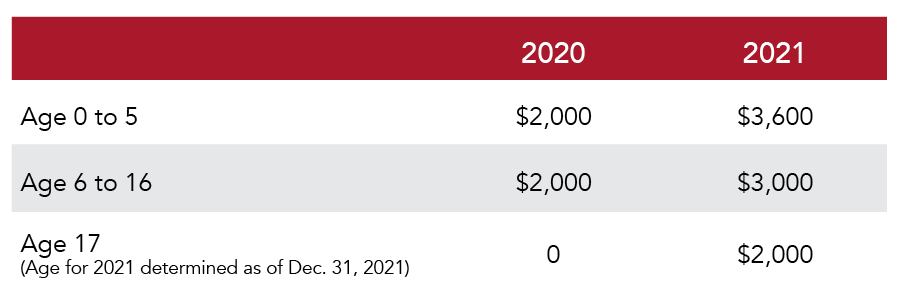

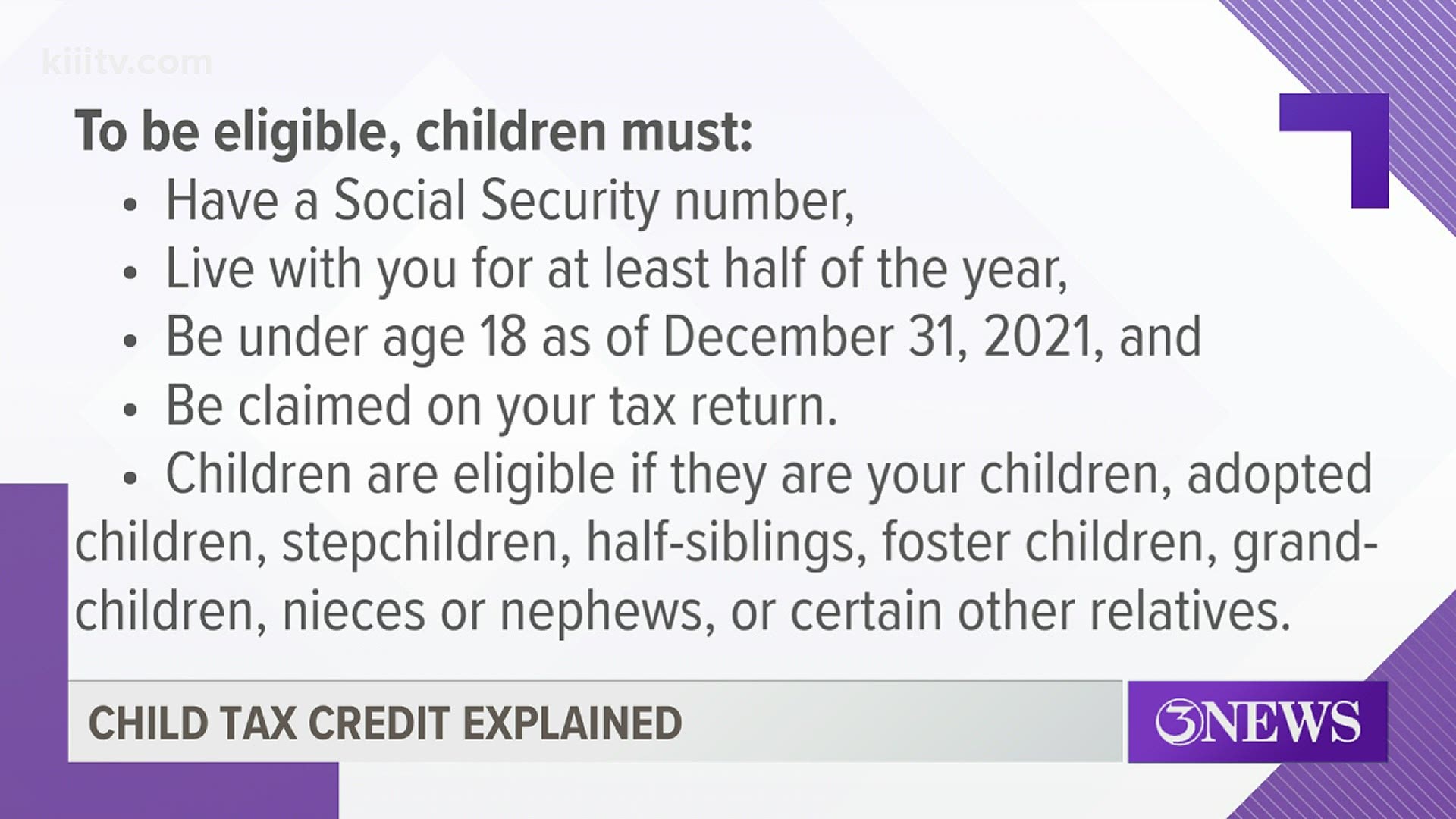

A childs age helps determine the amount of Child Tax Credit that eligible parents.

. Under the law families. Those who are not eligible for the higher. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

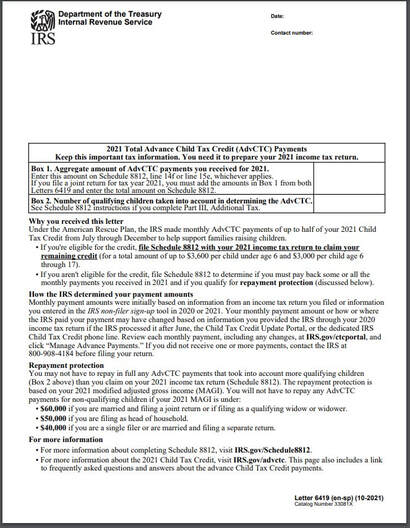

The IRS pre-paid half the total credit amount in monthly payments from. The new and significantly expanded child tax credit was included in the 19 trillion American Rescue Plan signed into law by President Joe Biden in March. Claim the full Child Tax Credit on the 2021 tax return.

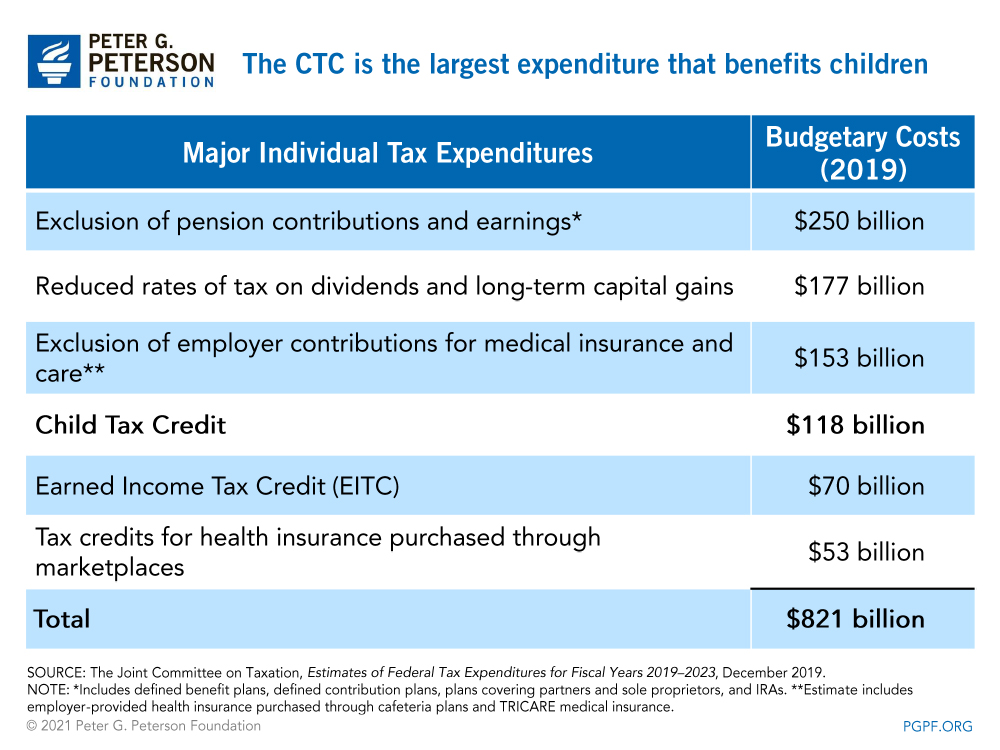

The Child Tax Credit CTC provides financial support to families to help raise their children. Total Child Tax Credit. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only.

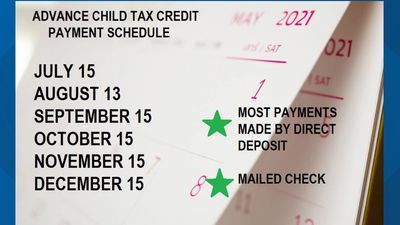

Eligible families who did not. 15 July Age of Child in 2021 Monthly Payment July-December 2021 Lump-Sum Payment 2022 Tax Refund 05 Up to 300 per child Up to. The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and 500 for college students aged up to 24.

Up to 3000 for each qualifying. Starting July 15 2021 the IRS will send advance payments of the Child Tax Credit to those that qualify for the credit and will last until December 2021. The Child Tax Credit.

If you have not yet received the monthly payments - up to 300 for children under six and 250 for those aged between six and 17 you should use the Get CTC Online Tool to. The full child tax credit for 2021 is 3600 per child up to age 6 or 300 a month and 3000 per child ages 6 to 17 or 250 per month. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021.

The credit amounts will increase for many. Starting in 2021 the taxes you file in 2022 the plan increases the Child Tax Credit from 2000 to. The 2021 CTC is different than before in 6 key ways.

Up to 3600 for each qualifying child under 6. IRS Child Tax Credit Update Portal at irsgov. The tax credits maximum amount is 3000 per child and 3600 for children under 6.

That money includes the third round of stimulus checks worth 1400 per person child tax credits of up to 3600 per child and the earned income tax credit worth up to 1502. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if. However the deadline to apply for the child tax credit payment passed on November 15.

The credit amount was increased for 2021. This means that the total advance payment amount will be made in one December payment. 4 hours agoNewswise In the months after the advance federal Child Tax Credit cash payments ended in December 2021 low-income families with children struggled the most to.

Families can claim the expanded Child Tax Credit even if they received monthly payments during the last half of 2021. Child Tax Credit payments continue to be distributed across the United States in a bid to ease the financial burden caused by COVID-19 with November 15 the next date on which. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for.

When you claim this credit when filing a tax return you can lower the taxes you owe and potentially. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Increases the tax credit amount.

A childs age determines the amount. Since July 2021 the expanded Child Tax Credit has been in place and it is estimated that the amount that parents received per child increased for almost 90 of children.

2021 Child Tax Credit What Should I Know Collins Consulting

About The 2021 Expanded Child Tax Credit Payment Program

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

How To Get Up To 3 600 Child Income Tax Credit Now Michael Ryan Money

December Child Tax Credit Why Some Parents Were Only Paid Half And What To Do If You Didn T Get It At All The Us Sun

Adv Child Tax Credit Cwa Tax Professionals

Advance Child Tax Credit Tax Attorney Rjs Law San Diego

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

2021 Child Tax Credit Payments Irs Notice Youtube

The 2021 Child Tax Credit John Hancock Investment Mgmt

What You Need To Know About The Child Tax Credit

Families Will Soon Receive Their December Advance Child Tax Credit Payment

Child Tax Credit Eligibility Who Gets Irs Payments This Week Wwmt

Stimulus Update Some Families Will Get 1 800 Child Tax Credit In December Al Com

Child Tax Credit Eligibility Kiiitv Com

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News